23 Oct Acquiring Properties from the Syracuse NY Land Bank

Purchasing properties from the Greater Syracuse Land Bank presents a unique opportunity for investors, first-time homebuyers, and developers to acquire real estate in Syracuse, NY. Here’s a breakdown of the process, financing options, and some considerations regarding profitability based on the low comps and After Repair Values (ARVs):

Purchasing properties from the Greater Syracuse Land Bank presents a unique opportunity for investors, first-time homebuyers, and developers to acquire real estate in Syracuse, NY. Here’s a breakdown of the process, financing options, and some considerations regarding profitability based on the low comps and After Repair Values (ARVs):

Purchase Process:

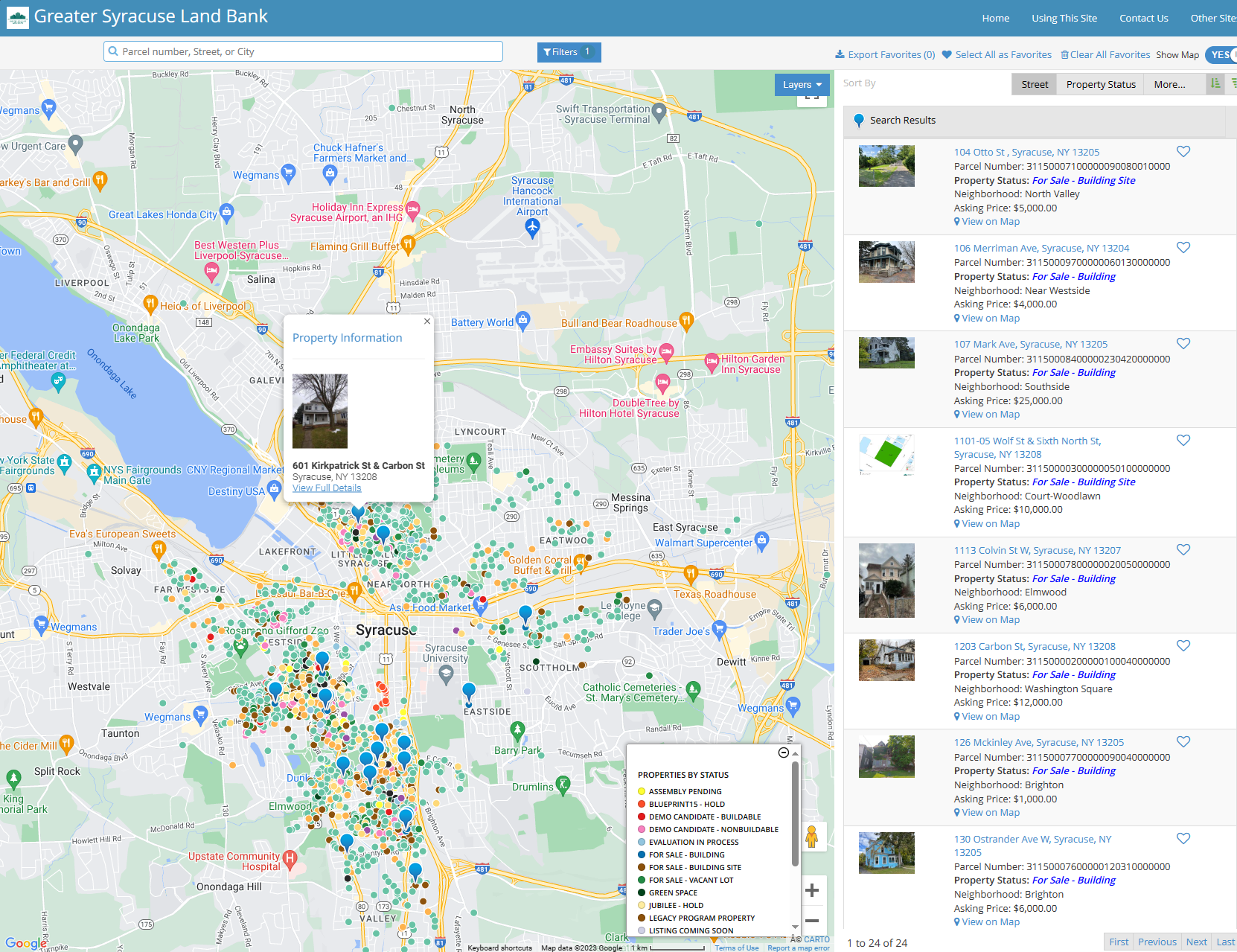

The process of acquiring a property from the Syracuse Land Bank involves viewing the available listings on their website, and following the instructions detailed in the listing notes for viewing and making purchase offers. Properties that require renovation are sold subject to an enforcement mortgage, which secures a lien against the property until the proposed renovations and other requirements are completed. Most listings come with a scope of work that buyers must complete within 12 months. Buyers need to fulfill all terms of sale, complete the proposed work, and obtain necessary certifications from Code Enforcement to be considered complete. First-time homebuyers are required to complete a HUD-approved homebuyer education course, with Home HeadQuarters offering such a course. Those who complete the course and are income-qualified may receive down payment and closing cost assistance1.

Financing and Discount Programs:

The Syracuse Land Bank offers discount programs to encourage redevelopment projects that align with their mission. Two notable programs include:

- Affordable Housing Development: Properties may be sold at a discounted price to applicants planning to develop income-restricted affordable housing, subject to certain conditions.

- Affordable Home Ownership: A sales price discount of 10% off the list price is offered to applicants who will owner-occupy the property for at least five years and whose household income is at or below 80% of the area median income1.

Profitability and Low Comps:

Acquiring properties at low prices from the Land Bank can be appealing; however, the profitability can be constrained by various factors. Some properties come with tax liens or are in such a state of disrepair that the cost of renovations may outweigh the potential profit, especially given the low comps and ARVs in certain areas of Syracuse2

Understanding the Local Market:

- Market Analysis: Conducting a thorough market analysis to understand the local real estate market, including property values, rental rates, and demand, is crucial.

- Comparative Market Analysis (CMA): A CMA will provide insight into how comparable properties are priced, which can be a useful benchmark when considering a purchase from the Land Bank.

Financial Analysis:

- Cost Estimation: Accurately estimating the cost of required renovations, along with any outstanding liens or other financial obligations, is crucial to assess the potential profitability.

- Financing: Explore various financing options, including traditional mortgages, hard money loans, or other real estate investment loans. The discount programs offered by the Land Bank may also provide financial benefits that enhance the attractiveness of certain properties.

Connecting with Local Experts:

- Networking: Connecting with local real estate agents, contractors, and other professionals can provide valuable insights and assistance in navigating the process.

- Real Estate Investment Groups: Joining local real estate investment groups can provide a platform to share experiences and learn from others who have invested in properties from the Land Bank or in the Syracuse area in general.

Due Diligence:

- Inspections: Conduct thorough inspections to uncover any hidden issues that could impact the cost of renovations and the overall profitability of the investment.

- Legal Compliance: Ensure compliance with all local zoning laws, building codes, and other regulatory requirements to avoid any legal complications.

Communicating with the Land Bank:

- Clarifications: Reach out to the Syracuse Land Bank for any clarifications regarding the purchase process, financing options, or eligibility for discount programs.

- Proposal Submission: Ensure your proposal is comprehensive and submitted in a timely manner as per the guidelines provided by the Land Bank.

It’s essential to approach the opportunity to purchase properties from the Syracuse Land Bank with a well-informed perspective. The low purchase prices can be enticing, but a thorough analysis to understand the full scope of the financial commitment and the potential for profit or community impact is necessary to make a sound investment decision.

Sorry, the comment form is closed at this time.